Auto loan calculator simplifies the process of understanding car financing, making it easier to plan and save money.

It provides insights into monthly payments, interest rates, and loan terms, empowering users to make informed decisions.

Introduction to Auto Loan Calculator

An auto loan calculator is a tool used to estimate the monthly payments and total cost of a car loan based on factors such as loan amount, interest rate, and loan term. It helps individuals evaluate their budget and determine the affordability of a car loan before committing to a purchase.

How Auto Loan Calculator Works

Auto loan calculators typically require inputs such as loan amount, interest rate, loan term, and sometimes additional fees like taxes and insurance. The calculator then uses this information to calculate the monthly payment amount, total interest paid over the life of the loan, and the total cost of the loan.

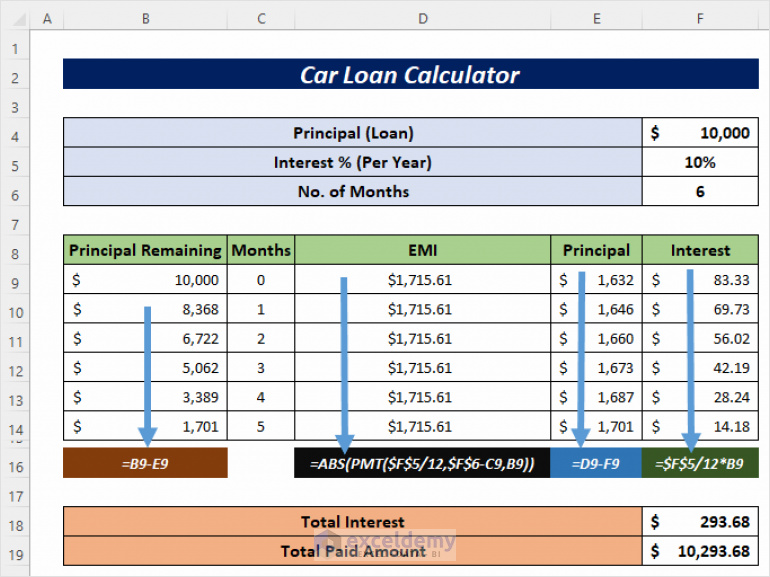

- Auto loan calculators use a formula to calculate monthly payments based on the loan amount, interest rate, and loan term. The formula takes into account the principle and interest components of each payment.

- Some calculators may also provide a breakdown of the amortization schedule, showing how much of each payment goes towards the principal balance and how much goes towards interest.

- By adjusting the inputs such as the loan amount or term, individuals can see how different factors impact the total cost of the loan and monthly payments, helping them make informed decisions.

Popular Auto Loan Calculators Online

- Bankrate Auto Loan Calculator: This calculator allows users to compare loan terms and see how different interest rates affect payments.

- Cars.com Auto Loan Calculator: Users can input trade-in value, down payment, and other fees to get a comprehensive view of their loan options.

- Edmunds Auto Loan Calculator: This tool provides a detailed breakdown of costs, including taxes, fees, and estimated monthly payments.

Importance of Using an Auto Loan Calculator

When considering purchasing a car, using an auto loan calculator can be incredibly beneficial in helping you make informed financial decisions. By utilizing this tool, you can accurately estimate your monthly payments, total interest costs, and the overall affordability of the loan.

Benefits of Using an Auto Loan Calculator

- Allows for Financial Planning: An auto loan calculator helps you plan your budget effectively by providing a clear breakdown of your monthly payments. This enables you to assess whether you can comfortably afford the loan without compromising your other financial obligations.

- Saves Time and Money: By using an auto loan calculator, you can compare different loan options, interest rates, and repayment terms to find the most cost-effective solution. This can save you time that would have been spent manually calculating these figures, and ultimately save you money by choosing the best loan option for your situation.

- Empowers Informed Decisions: With the detailed information provided by an auto loan calculator, you can make informed decisions about the type of car you can afford, the loan amount that suits your budget, and the repayment schedule that aligns with your financial goals. This empowers you to enter the car buying process with confidence and clarity.

Key Features of an Auto Loan Calculator

When using an auto loan calculator, there are several key features that make the tool efficient and user-friendly. These features ensure accurate calculations and help individuals make informed decisions when it comes to auto loans.

Essential Input Fields

An auto loan calculator typically requires the following essential input fields:

- Loan Amount: This is the total amount of the loan you are seeking.

- Interest Rate: The annual interest rate offered by the lender.

- Loan Term: The duration of the loan in months or years.

- Down Payment: The initial amount you pay upfront towards the purchase of the vehicle.

Calculation Process

The auto loan calculator uses the input fields to calculate various aspects of the loan:

- Monthly Payments: The calculator determines the monthly installment amount based on the loan amount, interest rate, and loan term.

- Interest Rates: It calculates the total interest you will pay over the loan term.

- Loan Terms: The calculator helps you understand how the loan term affects your monthly payments and total interest paid.

Formula for calculating monthly payment: P = [r*PV]/[1 – (1 + r)^(-n)]

User-Friendly Features

Auto loan calculators often come with additional features that enhance user experience:

- Amortization Schedule: Some calculators provide a detailed breakdown of each payment, showing how much goes towards principal and interest.

- Graphical Representation: Visual aids such as charts or graphs help users understand the loan repayment process better.

- Comparison Tools: Users can compare different loan options side by side to make better decisions.

How to Use an Auto Loan Calculator

To effectively use an auto loan calculator, follow these step-by-step instructions to input the necessary information and interpret the results.

Step-by-Step Guide

- Start by entering the loan amount you wish to borrow. This is the total amount of money you will receive from the lender.

- Next, input the annual interest rate provided by the lender. This rate will determine the amount of interest you will pay on the loan.

- Then, enter the loan term in years. This is the duration over which you will repay the loan.

- Some calculators may also ask for additional information such as down payment amount or trade-in value. Make sure to provide all relevant details accurately.

Interpreting Results

- Once you have entered all the required information, the auto loan calculator will generate the monthly payment amount you need to make.

- It will also show you the total amount of interest you will pay over the loan term, giving you a clear picture of the overall cost of borrowing.

- Additionally, the calculator may provide a detailed amortization schedule, outlining how each payment is allocated towards principal and interest.

- Input the loan amount, interest rate, and loan term for each offer into the auto loan calculator.

- Consider any additional fees or charges associated with each loan option, such as origination fees or prepayment penalties.

- Compare the monthly payments, total interest paid, and the overall cost of each loan to determine the most cost-effective option.

- Utilize the total cost of borrowing feature on the calculator to see the complete picture of how much each loan will cost you over the term.

- Pay attention to the total interest paid, as this can significantly impact the overall affordability of the loan.

- Compare the total cost of borrowing for each loan option to identify the most budget-friendly choice.

- Scenario 1: Loan A offers a lower interest rate but comes with higher fees, while Loan B has a slightly higher interest rate but no additional charges. Using the calculator, you can determine which loan will be more affordable in the long run.

- Scenario 2: Loan C has a longer loan term with lower monthly payments, but Loan D has a shorter term with higher payments. By comparing the total cost of borrowing for both options, you can decide which loan aligns better with your financial goals.

- Knowing the estimated loan payments in advance allows buyers to set a budget and stick to it during negotiations with dealers.

- By understanding the financial implications of different loan options, buyers can confidently discuss terms with dealers and avoid being swayed by misleading offers.

- Pre-calculating loan payments also helps buyers identify any hidden fees or unnecessary add-ons, ensuring they get the best deal possible.

- John used an auto loan calculator to estimate his monthly payments before visiting a dealership. Armed with this information, he was able to negotiate a lower interest rate and save thousands of dollars over the life of the loan.

- Mary compared different loan offers using an online calculator and discovered that she could afford a higher-priced car with a longer loan term. This allowed her to drive away with her dream car without breaking the bank.

- Tom used an auto loan calculator to understand the impact of a down payment on his monthly payments. This knowledge helped him negotiate a better deal with the dealer and secure a lower overall cost for the car.

- Provide the exact loan amount you intend to borrow without rounding off figures.

- Enter the interest rate offered by the lender, ensuring it reflects the current market rates.

- Include the loan term in months, not years, for precise calculations.

- Factor in any additional fees or charges associated with the loan to get a comprehensive view of the total cost.

- Review the monthly payment amount to determine if it fits within your budget constraints.

- Assess the total interest paid over the loan term to understand the cost of borrowing.

- Compare different loan scenarios to choose the most favorable option based on your financial situation.

- Consider the impact of a larger down payment or shorter loan term on your overall costs.

- Use the calculator to experiment with various loan terms and interest rates to find an optimal combination.

- Explore the effects of making extra payments or refinancing options to accelerate loan repayment.

- Save the results for future reference or comparison when reviewing loan offers from different lenders.

- Consult with a financial advisor to analyze the results and gain additional insights into your loan options.

- Financial literacy involves having the knowledge and skills to make informed financial decisions.

- Understanding key financial concepts such as interest rates, loan terms, and monthly payments is essential when using an auto loan calculator.

- Financial literacy can help individuals avoid costly mistakes and ensure they are getting the best possible deal on their auto loan.

- Auto loan calculators provide a practical way to apply financial concepts to real-life situations.

- By inputting different loan amounts, interest rates, and terms into the calculator, users can see firsthand how these variables impact their monthly payments.

- Resources like financial education websites, online courses, and personal finance books can further enhance financial literacy and empower individuals to make sound financial decisions.

- By inputting the purchase price, down payment, loan term, and interest rate into the calculator, Sarah can compare various scenarios.

- After analyzing the outcomes, Sarah realizes that opting for a shorter loan term with a slightly higher monthly payment saves her money in interest payments over the long run.

- Thanks to the auto loan calculator, Sarah can confidently negotiate with lenders and choose the most cost-effective loan option that fits her budget.

- By entering his current loan balance, remaining term, interest rate, and the new interest rate he qualifies for, John can see how much he can save each month.

- After comparing the outcomes, John discovers that refinancing his car loan at a lower interest rate significantly reduces his monthly payments, allowing him to reallocate those savings towards other financial goals.

- Utilizing the auto loan calculator empowers John to make an informed decision that positively impacts his monthly budget and overall financial well-being.

Factors Affecting Auto Loan Calculations

When calculating auto loans, several factors come into play that can significantly impact the overall cost and monthly payments. Understanding these factors is crucial for making informed decisions when taking out an auto loan.

Credit Score Impact

Your credit score plays a vital role in determining the interest rate you will receive on your auto loan. A higher credit score typically results in a lower interest rate, which can lead to lower monthly payments. On the other hand, a lower credit score may result in a higher interest rate, increasing the total cost of the loan over time.

Role of Interest Rates

Interest rates directly affect the amount of interest you will pay over the life of the loan. Higher interest rates mean more money paid in interest, increasing the total cost of the loan. Lower interest rates, on the other hand, can help reduce the overall cost of the loan. It’s essential to shop around for the best interest rate to save money in the long run.

Other Variables Impacting Total Cost

Apart from credit score and interest rates, several other variables can affect the total cost of an auto loan. These include the loan term, down payment amount, trade-in value, and any additional fees or charges. Adjusting these variables can have a significant impact on the monthly payments and the total amount paid for the loan.

Comparing Auto Loan Offers Using a Calculator

When it comes to comparing different auto loan offers, using an auto loan calculator can be a valuable tool in helping you make an informed decision. By inputting key details of each loan option, you can evaluate the total cost of borrowing and determine which offer best fits your financial needs.

Tips for Comparing Auto Loan Offers

Evaluating Total Cost of Borrowing

Examples of Decision-Making Scenarios

Understanding Different Types of Auto Loan Calculators

When it comes to auto loan calculators, there are typically two main types: simple and advanced. Each type serves a specific purpose and offers different functionalities to help individuals make informed decisions when it comes to financing a vehicle.

Simple Auto Loan Calculators

Simple auto loan calculators are basic tools that provide essential information regarding loan payments. They typically require inputs such as the loan amount, interest rate, and loan term to calculate monthly payments. These calculators are user-friendly and straightforward, making them ideal for individuals who want a quick estimate of their potential loan payments without diving into complex details.

Advanced Auto Loan Calculators

On the other hand, advanced auto loan calculators offer more comprehensive insights into auto financing. These calculators may include additional features such as the ability to factor in trade-in value, taxes, fees, and down payments. Advanced calculators provide a more detailed breakdown of the loan structure, total interest paid, and the impact of different variables on the overall cost of the loan. They are suitable for individuals who want a more in-depth analysis of their auto loan options and the flexibility to adjust various parameters to see how they affect the overall loan terms.

It is recommended to use a simple auto loan calculator if you are looking for a quick estimate of your monthly payments and prefer a straightforward approach. On the other hand, if you want a more detailed analysis of your auto loan options and are interested in exploring various scenarios to optimize your financing, an advanced auto loan calculator would be the more suitable choice.

Benefits of Estimating Loan Payments Before Visiting a Dealership

Estimating loan payments before visiting a dealership can provide numerous advantages to car buyers. By having a clear idea of the expected monthly payments, individuals can make informed decisions and negotiate effectively with dealers. This proactive approach empowers buyers and helps them secure favorable terms for their auto loans.

Empowering Negotiations

Real-Life Examples

Tips for Using an Auto Loan Calculator Effectively

When utilizing an auto loan calculator, it is essential to input accurate information to obtain precise results for your loan calculation. Understanding how to interpret the outcomes and leveraging the calculator’s features can empower you to make well-informed decisions regarding your auto loan. Here are some tips to help you maximize the utility of an auto loan calculator:

Strategies for Accurate Input

Interpreting Results and Making Informed Decisions

Maximizing Utility of an Auto Loan Calculator

Financial Literacy and Auto Loan Calculators

Financial literacy plays a crucial role in effectively utilizing an auto loan calculator. Understanding loan terms and calculations can greatly improve financial decision-making, leading to more informed choices when it comes to auto financing.

The Role of Financial Literacy

Enhancing Financial Literacy with Auto Loan Calculators

Case Studies or Examples Using Auto Loan Calculators

In this section, we will explore real-world examples of individuals utilizing auto loan calculators to make informed financial decisions and analyze the impact of these tools on their loan scenarios and overall financial planning.

Case Study 1: First-time Car Buyer

A young professional, Sarah, is looking to purchase her first car. She has a budget in mind but is unsure about the monthly payments she can afford. Sarah decides to use an auto loan calculator to estimate different loan terms and interest rates.

Case Study 2: Refinancing a Car Loan

John, a seasoned car owner, is considering refinancing his current auto loan to lower his monthly payments. He decides to use an auto loan calculator to evaluate different refinancing options.

Last Point

Utilize an auto loan calculator to estimate costs, compare offers, and enhance financial literacy for better decision-making.