Loan pre-approval sets the stage for a successful home purchase journey, offering insights into its significance and benefits. Dive into the world of pre-approval and unlock the doors to your dream home.

Understanding the process, requirements, and advantages of loan pre-approval is crucial for a smooth and efficient home buying experience.

Overview of Loan Pre-Approval

Loan pre-approval is a process where a lender reviews your financial information and determines the amount you can borrow for a mortgage. It involves a more in-depth analysis compared to pre-qualification, providing a conditional commitment for a loan.

Importance of Getting Pre-Approved Before House Hunting

Before starting your house-hunting journey, it is crucial to get pre-approved for a loan. This step helps you understand your budget, saves time by focusing on properties within your price range, and makes your offer more attractive to sellers.

Difference Between Pre-Qualification and Pre-Approval

- Pre-Qualification: Based on self-reported information, it provides an estimate of how much you could borrow. It is a preliminary assessment and does not guarantee a loan.

- Pre-Approval: Requires documentation and a thorough financial review by the lender. It offers a conditional commitment for a specific loan amount, helping you stand out in a competitive real estate market.

Benefits of Loan Pre-Approval

Obtaining a pre-approved loan offers several advantages that can streamline the home buying process and provide a competitive edge.

Competitive Edge in Home Buying Process

- Pre-approval demonstrates to sellers that you are a serious buyer with the financial capability to make a purchase, increasing your credibility in a competitive market.

- Having a pre-approved loan can expedite the closing process, giving you an advantage over other potential buyers who have not secured financing.

- Sellers may be more inclined to negotiate and accept your offer over others who have not taken the step of loan pre-approval.

Setting a Realistic Budget

- With pre-approval, you will know exactly how much you can borrow, helping you set a realistic budget for your home purchase.

- Knowing your budget in advance can prevent you from falling in love with a property that is beyond your financial means.

- Pre-approval can also save you time by focusing your search on properties that are within your approved loan amount.

Eligibility Criteria for Loan Pre-Approval

When applying for a pre-approved loan, there are specific requirements that lenders typically look for to assess your eligibility. These criteria play a crucial role in determining whether you qualify for a pre-approved loan or not.

Credit Score

Having a good credit score is essential for loan pre-approval. Lenders use your credit score to evaluate your creditworthiness and determine the risk of lending to you. A higher credit score indicates a lower risk for the lender, making you more likely to receive a pre-approved loan. Maintaining a good credit score by paying bills on time and keeping credit card balances low can improve your chances of getting pre-approved for a loan.

Stable Income and Employment History

Another crucial factor in obtaining a pre-approved loan is having a stable income and employment history. Lenders want to ensure that you have a reliable source of income to repay the loan. A consistent employment history demonstrates financial stability and reduces the risk for the lender. Providing proof of steady income through pay stubs or tax returns can strengthen your application for a pre-approved loan.

Documentation Needed for Loan Pre-Approval

When applying for a loan pre-approval, there are specific documents that you will need to provide to the lender. These documents are crucial for the pre-approval process as they help the lender assess your financial situation and determine your eligibility for a loan.

List of Documents Required:

- Proof of identification (such as driver’s license or passport)

- Proof of income (recent pay stubs, W-2 forms, or tax returns)

- Proof of assets (bank statements, investment account statements)

- Proof of employment (employment verification letter)

- Credit history report

- Proof of residency (utility bills or lease agreement)

- Additional documents specific to the lender’s requirements

Importance of Providing These Documents:

These documents are necessary for the lender to verify your identity, income, assets, and employment status. They also help the lender assess your creditworthiness and determine the amount of loan you may qualify for. By providing these documents, you are demonstrating your financial stability and ability to repay the loan, increasing your chances of getting pre-approved.

Tips for Organizing and Preparing the Required Paperwork:

- Start gathering the necessary documents in advance to avoid any delays in the pre-approval process.

- Make copies of all the documents for your own records.

- Organize the documents in a folder or binder to keep them secure and easily accessible.

- Double-check that all documents are up to date and contain accurate information.

- Communicate with your lender to ensure you have provided all the required documents and address any questions or concerns promptly.

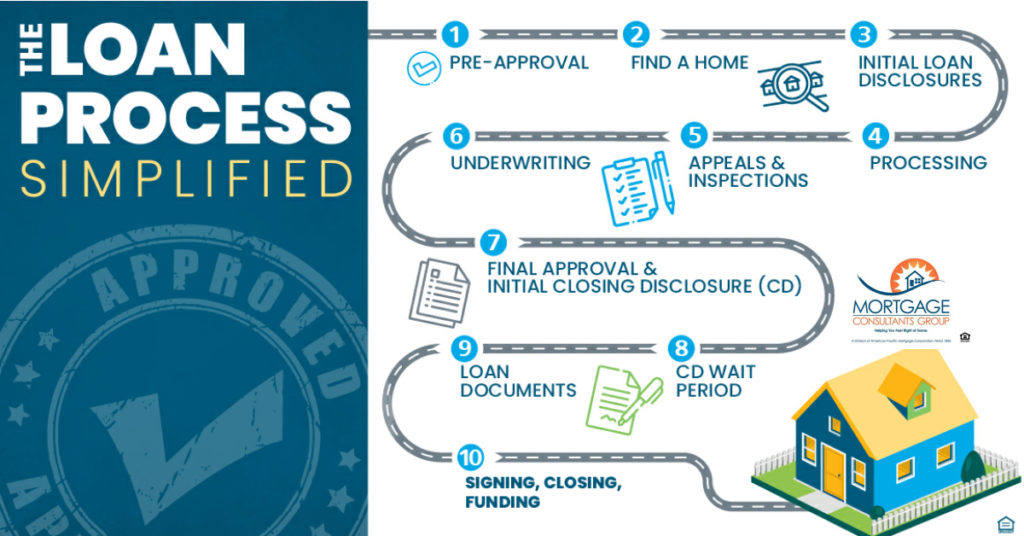

Steps to Obtain Loan Pre-Approval

Applying for a loan pre-approval involves a series of steps that help lenders evaluate your financial situation and determine if you qualify for a loan. Let’s walk through the process.

1. Application Submission

- Complete the loan application form provided by the lender.

- Submit necessary documents such as income proof, identification, and credit history.

- Provide accurate information to avoid delays in the approval process.

2. Lender Evaluation

- Lenders assess your credit score, income, debt-to-income ratio, and employment stability.

- They analyze your financial situation to determine your ability to repay the loan.

- Any discrepancies or red flags may lead to further scrutiny or denial of pre-approval.

3. Pre-Approval Decision

- Once the evaluation is complete, the lender will notify you if you are pre-approved for a loan.

- You will receive a pre-approval letter outlining the loan amount you qualify for.

- Pre-approval does not guarantee final loan approval but indicates a strong likelihood of approval.

4. Timeline

- The timeline for obtaining loan pre-approval varies based on the lender and your responsiveness in providing required documents.

- Typically, pre-approval can be obtained within a few days to a week after application submission.

- Ensure prompt action to expedite the pre-approval process and move closer to securing your desired loan.

Common Mistakes to Avoid in Loan Pre-Approval

When applying for a loan pre-approval, there are common mistakes that applicants should steer clear of to ensure a smooth process and increase their chances of approval.

Not Checking Credit Score

It is crucial to check your credit score before applying for a loan pre-approval. A low credit score can result in a higher interest rate or even rejection of your application. Make sure to review your credit report for any errors and address them before starting the pre-approval process.

Overspending Before Approval

Avoid making large purchases or taking on additional debt before getting pre-approved for a loan. Lenders evaluate your debt-to-income ratio, and sudden changes can impact your eligibility. Keep your financial situation stable and avoid unnecessary expenses during the pre-approval process.

Changing Jobs

Switching jobs during the pre-approval process can raise red flags for lenders. Stability in employment is a positive factor in loan approvals, so try to maintain your current job status until you secure the pre-approval. Changing jobs can delay the process or even lead to rejection.

Skipping Pre-Approval

Some applicants skip the pre-approval step and directly apply for a loan, assuming they will get approved easily. However, pre-approval provides clarity on your budget, interest rates, and loan options. Skipping this step can result in disappointment or approval for a lower amount than expected.

Providing Incomplete Documentation

Incomplete documentation can slow down the pre-approval process or lead to rejection. Ensure you provide all required documents accurately and in a timely manner. Missing paperwork can create delays and impact the lender’s decision.

Ignoring Pre-Approval Conditions

Be aware of the conditions set during the pre-approval process. Ignoring or not meeting these conditions can result in the withdrawal of the pre-approval offer. Stay informed about the requirements and adhere to them to secure your loan pre-approval successfully.

Understanding Interest Rates in Loan Pre-Approval

When it comes to loan pre-approval, understanding interest rates is crucial as it directly impacts your monthly payments and overall loan costs. Interest rates are determined based on various factors such as market conditions, your credit score, loan amount, and loan term.

Factors Affecting Interest Rates

- Market Conditions: Interest rates can fluctuate based on the current economic environment and the policies set by the central bank.

- Credit Score: A higher credit score typically leads to lower interest rates, as it signifies to lenders that you are a lower risk borrower.

- Loan Amount: Larger loan amounts may come with higher interest rates due to the increased risk for the lender.

- Loan Term: Shorter loan terms usually have lower interest rates compared to longer loan terms.

Impact of Interest Rates

- Monthly Payments: Higher interest rates result in higher monthly payments, while lower interest rates lead to more affordable monthly payments.

- Overall Loan Costs: A slight difference in interest rates can significantly impact the total amount you pay over the life of the loan. It’s essential to secure a favorable interest rate to save money in the long run.

Strategies for Securing Favorable Interest Rates

- Improve Your Credit Score: Work on improving your credit score before applying for a pre-approved loan to qualify for lower interest rates.

- Shop Around: Compare interest rates offered by different lenders to find the best deal that suits your financial situation.

- Consider a Shorter Loan Term: Opting for a shorter loan term can help you secure a lower interest rate and save on overall interest costs.

- Negotiate: Don’t hesitate to negotiate with lenders to see if they can offer you a better interest rate based on your financial profile.

Comparison of Different Lenders for Loan Pre-Approval

When seeking loan pre-approval, it is crucial to compare offers from various lenders to ensure you secure the best deal possible. Each lender may have different terms, interest rates, and fees, so evaluating multiple options can help you find the most suitable one for your financial situation.

Factors to Consider When Evaluating Loan Offers for Pre-Approval

- Interest Rates: Compare the interest rates offered by different lenders to understand the cost of borrowing.

- Fees and Charges: Take into account any additional fees or charges associated with the loan, such as origination fees or prepayment penalties.

- Loan Terms: Consider the duration of the loan, the monthly payments, and the overall repayment schedule.

- Customer Service: Evaluate the quality of customer service provided by the lender to ensure a smooth borrowing experience.

Tips on How to Choose the Right Lender for a Pre-Approved Loan

- Shop Around: Don’t settle for the first offer you receive. Take the time to compare offers from different lenders.

- Check Reviews: Look up reviews and ratings of the lenders to get an idea of their reputation and customer satisfaction.

- Negotiate: Don’t be afraid to negotiate terms with the lenders to see if you can secure a better deal.

- Consider Your Needs: Choose a lender that meets your specific requirements and financial goals.

Real-Life Examples of Successful Loan Pre-Approvals

When it comes to securing a loan pre-approval, real-life examples can provide valuable insights into how this process can benefit individuals in their home buying journey. Here are some stories of successful loan pre-approvals:

Case Study 1: The Smith Family

- The Smith family decided to purchase their dream home, but they were unsure about their financial eligibility. They approached a lender for a pre-approval, which helped them determine their budget and streamline the house hunting process.

- With the pre-approval in hand, the Smith family was able to make a strong offer on a house they loved, giving them a competitive edge over other potential buyers.

- Key Takeaway: A loan pre-approval not only provides clarity on your budget but also positions you as a serious buyer in the real estate market.

Case Study 2: Sarah’s Success Story

- Sarah, a first-time homebuyer, was initially hesitant to apply for a pre-approval due to her limited credit history. However, after consulting with a lender, she discovered that she qualified for a loan pre-approval based on her income and savings.

- Having the pre-approval letter empowered Sarah to confidently make offers on properties within her budget, ultimately leading her to find a perfect starter home.

- Key Takeaway: Even with limited credit history, a thorough evaluation of your financial situation can still result in a successful loan pre-approval.

Ultimate Conclusion

In conclusion, securing a loan pre-approval not only simplifies the house hunting process but also positions you as a strong contender in the competitive real estate market. Take the first step towards your homeownership goals with confidence and clarity.